Dave Ramsey bluntly speaks on Social Security, 401(k)s, retirement

For Americans preparing for retirement, financial security and maintaining preferred lifestyles after leaving the workforce are top priorities.

Many retirees worry about their future Social Security paychecks and determining to what degree they will be able to depend on their 401(k) plans for retirement income.

Daily living costs — such as food, utilities, transportation, and entertainment — are significant budget considerations.

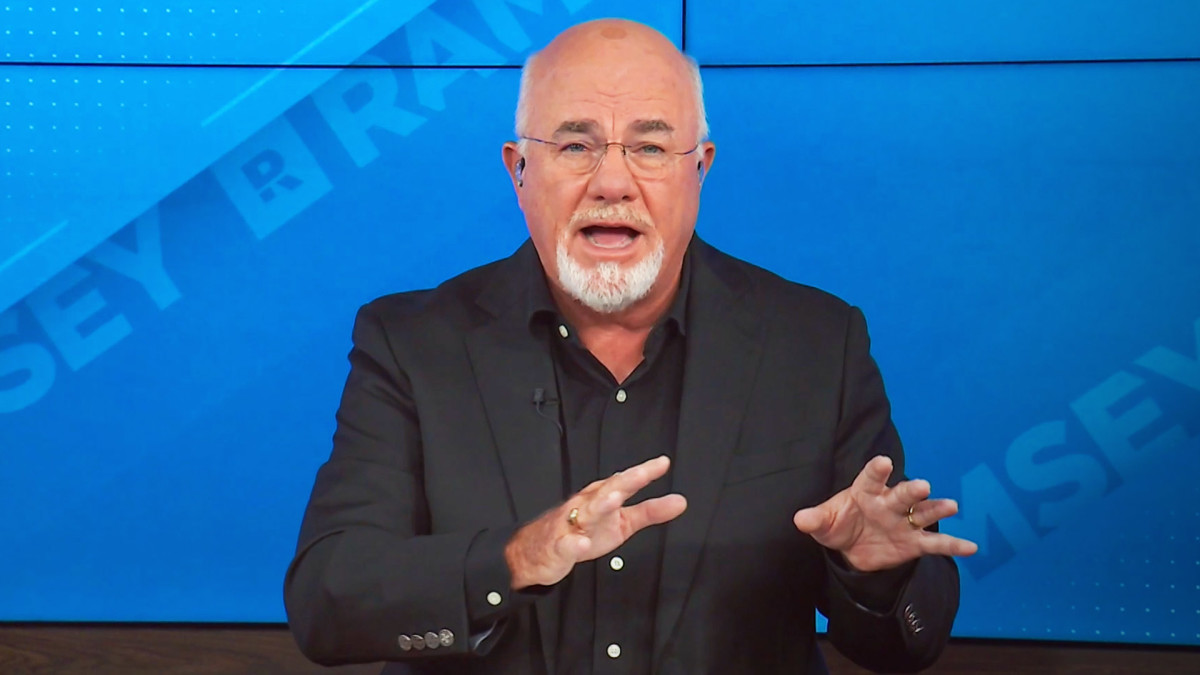

Personal finance expert and bestselling author Dave Ramsey provides valuable insights on Social Security, 401(k)s, and practical strategies for a fulfilling retirement.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

With increasing life expectancies and unpredictable financial markets, retirees must plan carefully to ensure their savings last throughout their retirement years.

To safeguard their finances, many contribute to 401(k)s, IRAs, and other accounts while also addressing tax implications to maintain long-term stability.

Health care costs present another challenge, as medical needs tend to rise with age. Many retirees worry that rising costs will make it harder to sustain their preferred lifestyle, particularly those who rely heavily on Social Security benefits.

Related: Dave Ramsey sounds alarm for Americans on Social Security

While Social Security is an essential part of retirement income, depending entirely on it carries uncertainty. Questions about its future, cost-of-living adjustments, and potential reductions in benefits due to dwindling trust funds add to retirees’ financial concerns.

With these key realities in mind, Ramsey offers important thoughts on Social Security and 401(k)s, providing Americans with strategies to set priorities in an effort to make some practical sense out of the complex issues at hand.

Image source: TheStreet

Dave Ramsey has blunt words on Social Security, 401(k)s

The Social Security Administration reports that in 2023, 2.7 workers supported each beneficiary, but this ratio is expected to drop to 2.4 by 2035 as more baby boomers retire.

Ramsey warns Americans that Social Security trust funds may only cover full benefits until 2034, after which payments could shrink to 80% without government action.

He also stresses that Social Security should supplement, not replace, retirement saving and that people can secure their financial future by investing in 401(k) plans and IRAs over their careers.

More on retirement:

- Dave Ramsey sounds alarm for Americans on Social Security

- Scott Galloway warns Americans on 401(k), US economy threat

- Shark Tank’s Kevin O’Leary has message on Social Security, 401(k)s

Ramsey has previously explained to TheStreet his views on the advantages of investing over the long haul in 401(k) plans as opposed to reacting in the moment to the news of the day.

“The stock market over a decade is a wise old woman. And so she’s wonderful long term,” Ramsey said. “But you don’t want to mess with her short term, so just zoom back. Chill, look at the long term. Nobody gets hurt on a roller coaster except those that jump off in the middle of the ride.”

Related: Jean Chatzky warns Americans on Social Security, 401(k)s

Dave Ramsey explains a fulfilling retirement beyond Social Security and 401(k) planning

Ramsey added to these thoughts some real-life advice about happiness in retirement.

“You did it. You worked hard for decades, you saved consistently for retirement, and now you’re ready to cross the finish line into the wonderful world of retirement,” Ramsey wrote. “But be warned. You might roll out of bed on that first Monday morning and find yourself wondering, ‘Well. . . now what?'”

Ramsey answers the question by emphasizing that a happy retirement starts with financial freedom.

Paying off all debt, including mortgages, before retirement removes financial stress. Budgeting is crucial, with many fearing running out of money more than death. A zero-based budget and responsible withdrawal rates from 401(k)s and IRAs help secure stability. Investing wisely strengthens long-term wealth.

But importantly, Ramsey explains, retirement also provides a valuable opportunity to cherish and spend more time with family, maintain friendships, and pursue hobbies, which all improve well-being.

Traveling opens opportunities for adventure, and prioritizing health ensures a higher quality of life.

Thoughtful planning in these areas allows retirees to enjoy life to the fullest without financial worries weighing them down, Ramsey advises.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast

#Dave #Ramsey #bluntly #speaks #Social #Security #401ks #retirement