Stock Market Today: Bulls Make Money, Bears Make Money

End of Day Update

Let’s start with the numbers

Stocks ended slightly higher Monday, the first trading day of June.

The Dow Jones Industrial Average gained 35.41 points, or 0.08%, to end the session at 42,305.48, while the S&P 500 edged up 0.41% to close at 5,935.94, and the tech-heavy Nasdaq advanced 0.67% to finish the day at 19,242.61.

Here’s a chart of the intraday action:

ThinkOrSwim

We started the day with possible increased tariffs on steel imports which drove stocks like Nucor (NUE) and Steel Dynamics (STLD) higher. They remained among the best performers of the day.

But, as so often is the case, it was the big tech companies that took over to put the market into the plus column.

It was Meta (META) , Nvidia (NVDA) , and Broadcom (AVGO) , that were among the top performing mega-cap names, gaining 3.6%, 1.7%, and 2.7% respectively.

Breadth was unimpressive. Among the S&P 500 constituents there were nearly equal numbers of gainers vs. losers while on the NYSE, losing issues edged out the gainers by about 15%.

I guess we can say that it was the bulls who made money today. Just not that much. And since Lamborghini’s badge is a bull, let’s just finish off the day with a picture of a Lamborghini Countach.

James Ochoa

Initial Update. 9am ET.

Happy Monday and welcome to June. This year has flown by and will be 50% over in just a few weeks. Perhaps one of the reasons that it’s gone by so quickly is the sheer amount of news and volatility that we’ve had to absorb. It’s been anything but dull!

Year-to-date, the S&P 500 is up 0.51%. That’s after being down almost 18% year to date and 21% from the high. We’re now 22% off the April 7 low.

If you’ve been bullish or bearish, this market has provided the opportunity to make, and lose, money.

In May, the S&P 500 gained 6% to finish 4% off that February high.

I think heatmaps tell a great visual story, so let’s take a look at how S&P 500 constituents did in May.

finviz

Remember, the performance numbers you’re looking at in each block are the gains and losses for the entire month of May.

Who did well? The same stocks that have led for the past several years. Big Tech, except for Apple (AAPL) . And honestly Apple is the only one of the Mag 7 that hasn’t started to trend higher. Even Tesla (TSLA) , which was cut in half earlier in the year, is trending up.

Over on TheStreet Pro, Stephen Guilfoyle shares that earnings season is drawing to a close. He says that “according to FactSet, with about 98% of the S&P 500 having reported, 78% of firms so far have beaten earnings expectations while 64% of firms so far have beaten expectations for revenue generation.”

He also notes that health-care earnings were strong, showing growth of 43%. Which is so interesting because that’s the weakest sector shown above.

Doug Kass shared this tweet in his Daily Diary today, and health care may be a place to consider doing more research.

Persistent underperformance has left Health Care deeply oversold. The sector has lagged the S&P 500 by a staggering 42% over the last 3 years. Prior three-year oversold readings that approached or exceeded 2.0 standard deviations have occurred near relative lows for the sector. pic.twitter.com/sPH0eFOMeq

— Rob Anderson (@_rob_anderson) May 30, 2025

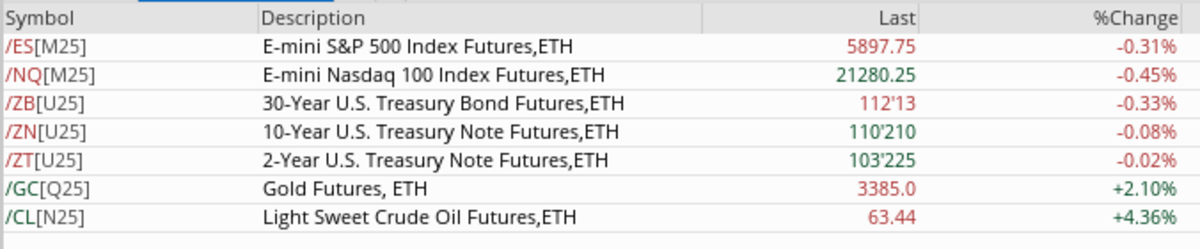

So, that’s May. But now it’s June. Let’s take a look at today’s futures.

ThinkOrSwim

Stocks look a little lower, with the S&P 500 and Nasdaq futures off by 0.31% and 0.45% respectively. Bonds are lower, too, across the yield curve, which will push rates higher. What’s doing well? Gold and crude oil.

Later this morning we’ll receive economic reports on S&P’s Manufacturing PMI and ISM Manufacturing. These will give us insight into the health of US manufacturing.

Related: Economy This Week: Jobs report will show whether tariffs are hitting economy

And since I’m an F1 fan and Google- and Mastercard-sponsored McLaren is leading the champsionship, here’s a pic of Oscar Piastri to make you feel motivated today.

Kym Illman/Getty Images

#Stock #Market #Today #Bulls #Money #Bears #Money